Publications

Featured Report

Generally Accepted Value for Money Analysis Principles & Standards

Value for Money (VfM) Analysis is a structured tool used to compare different project delivery methods, including Public-Private Partnerships (P3s), to determine the most cost-effective, risk-adjusted, and high-quality approach. Unlike benefit-cost analysis (BCA) or financial feasibility assessments, which determine whether a project is societally beneficial or financially viable, VfM Analysis focuses on evaluating the best delivery method for an already approved project by comparing projected financial risks, efficiencies, and performance metrics.

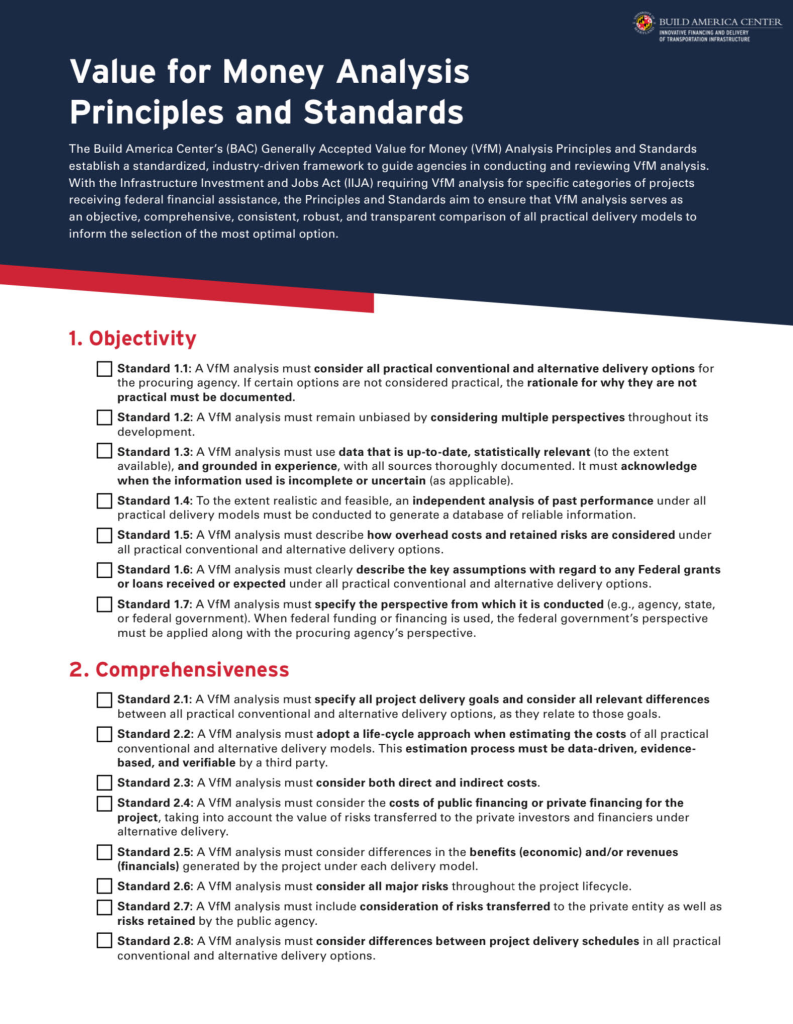

Generally Accepted Value for Money Analysis Principles & Standards: Checklist

This accompanying checklist offers a practical tool for agencies to ensure alignment with these principles throughout their VfM analyses.

All Publications

Risk Allocation and Sharing in Transportation P3s: State of Practice Report

The purpose of this report is to capture the state of practice of risk allocation and sharing in transportation P3s in the United States by: (1) providing an overview of risks and risk allocation in transportation P3s; (2) presenting how risks have been allocated in recent P3 transportation agreements; and (3) sharing perspectives of practitioners about current risk allocation practices.

Guidebook on Estimating Costs of Capital for Value for Money Assessments

As P3 consortia generally finance their projects with a combination debt and equity, the following research guide aims to provide a set of guidelines for practitioners on estimating the costs of debt and equity and an overall weighted average cost of capital (WACC) for P3 projects for early stage VfM assessments.

State Infrastructure Banks, the Bipartisan Infrastructure Law, and Beyond

The objective of the research is to understand how states have used SIBs in the last five years and how they could use them going forward. Jumping off from the 2022 Report, the research will evaluate how SIBs have been used in context of other BIL programs and transportation trends. It will also evaluate projects or investments that states have considered but have not yet financed.

Guidebook on Policies and Estimation of Matching Funds for New BIL Grants

State transportation agencies face challenges in fully leveraging available Federal grants and innovative financing programs due to budgetary constraints. It is crucial to strategically manage limited funds over time to optimize the timing and quantity of capital projects, ensuring the best interests of the States. This report provides a deeper understanding of match requirements and explores methods to achieve these objectives.

Exploring the Potential of a Crowdfunding Program to Achieve Equitable EV Charging Infrastructure

The U.S. aims to make half of all new vehicles sold by 2030 zero-emissions and build 500,000 EV charging stations, supported by $7.5 billion from the Infrastructure Investment and Jobs Act. However, challenges such as the high cost of EVs and inequitable charging station placement remain. This paper proposes an EV crowdfunding program to address these issues and ensure compliance with federal regulations. The project aims to illustrate how financing works and benefits are calculated for disadvantaged communities enrolled in the crowdfunding program.

Comparing and Contrasting Design-Build-Finance-Operate-Maintain (DBFOM) and Master Development Agreement (MDA) Public Private Partnership (P3)

IMG Rebel Advisory, Inc. (“Rebel”) was engaged by the Build America Center (BAC), housed within the University of Maryland with support from the U.S. Department of Transportation, to explore the similarities

and differences between design-build-finance-operate-maintain (DBFOM) public-private partnerships (P3s) and master development agreement (MDA) P3s, which can generically be termed “infrastructure P3s” and “real estate P3s”, respectively, and in doing so, potentially derive any insights about each P3 type.